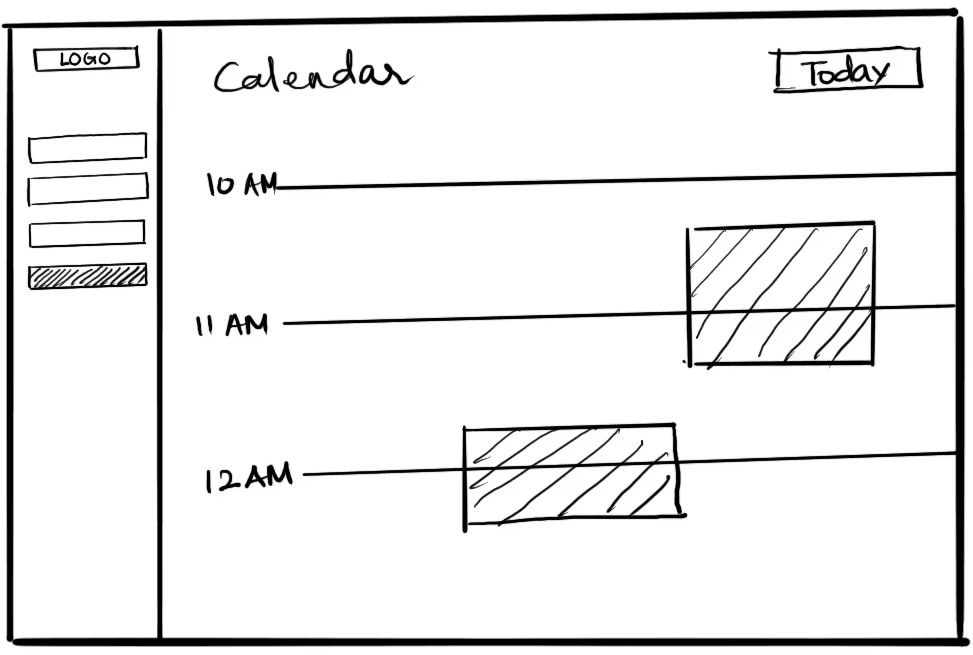

Product demo

Designed end-to-end user experience and interface and made prototypes for client presentation

THE PROBLEM

Banks expect RMs to deliver personalized, timely engagement, but outdated systems and disconnected workflows make this nearly impossible. RMs need a single, intelligent platform that consolidates customer insights, prioritizes actions, and supports daily decision-making.

USER RESEARCH

KEY INSIGHTS

Information is scattered across multiple tools, making it hard for RMs to keep track

Important events like large withdrawals or FD maturities are often noticed only much later

Monthly PDF scorecards offer no real-time visibility, RMs are unsure about their daily progress

Constant context switching between systems increases mistakes, slows decision-making, and affects call quality

ANALYZING EXISTING TOOLS

I analyzed some of the existing CRM tools in the market to understand more about the pain points and found the following:

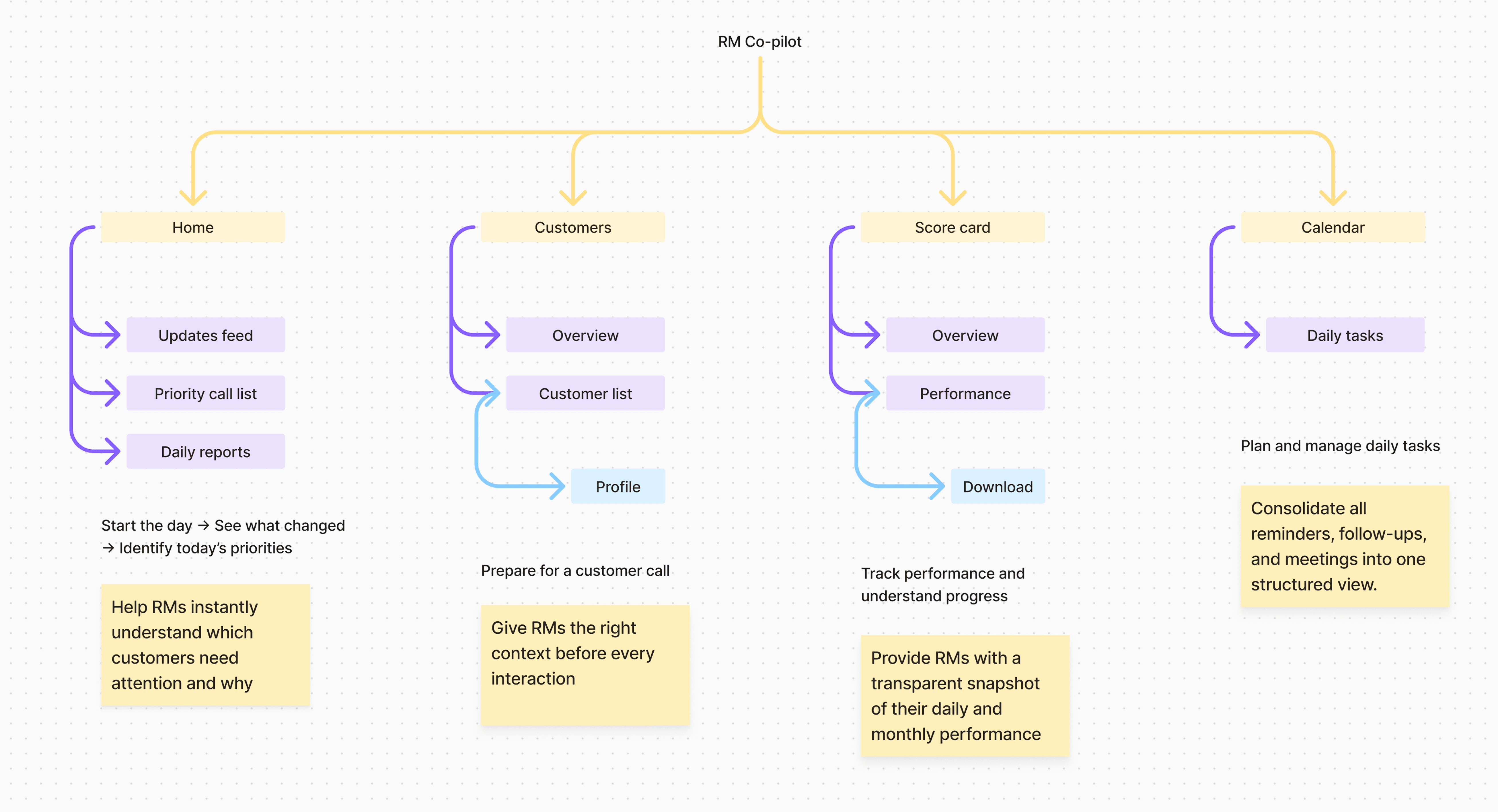

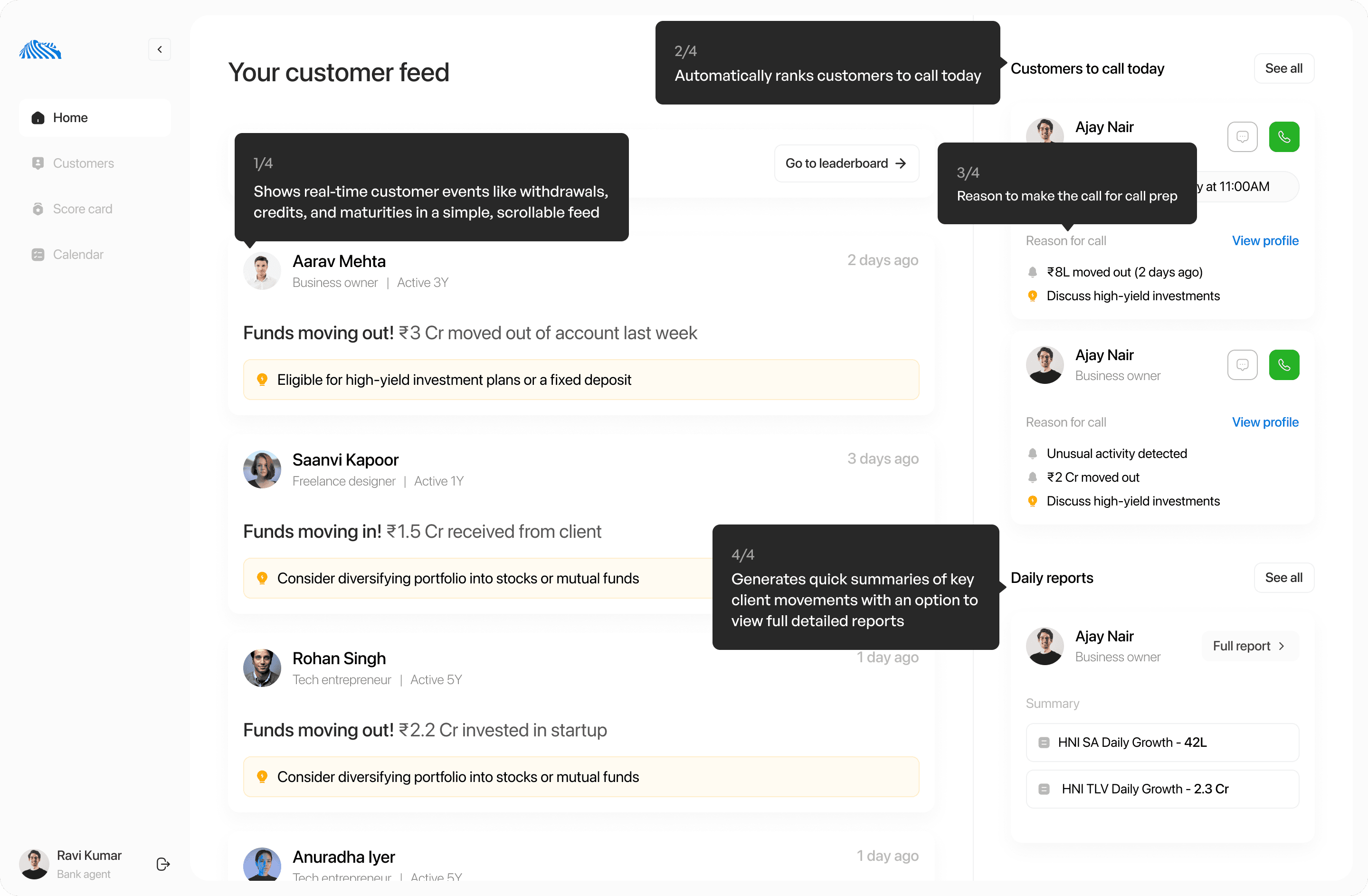

The home page gives RMs instant visibility into what changed across their customer portfolio today.

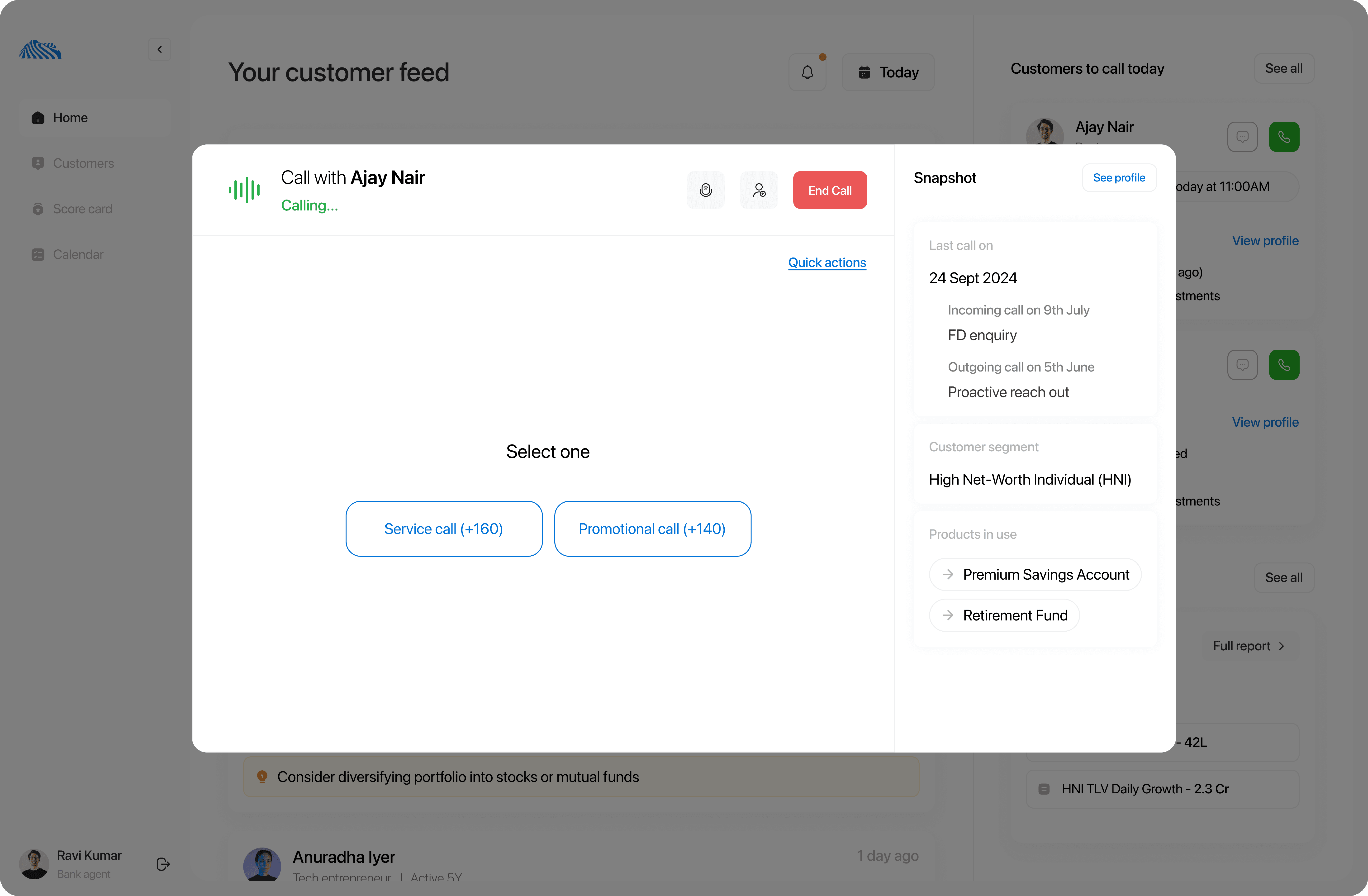

The calling screen helps RMs identify the call type instantly while showing a quick customer snapshot to guide the conversation.

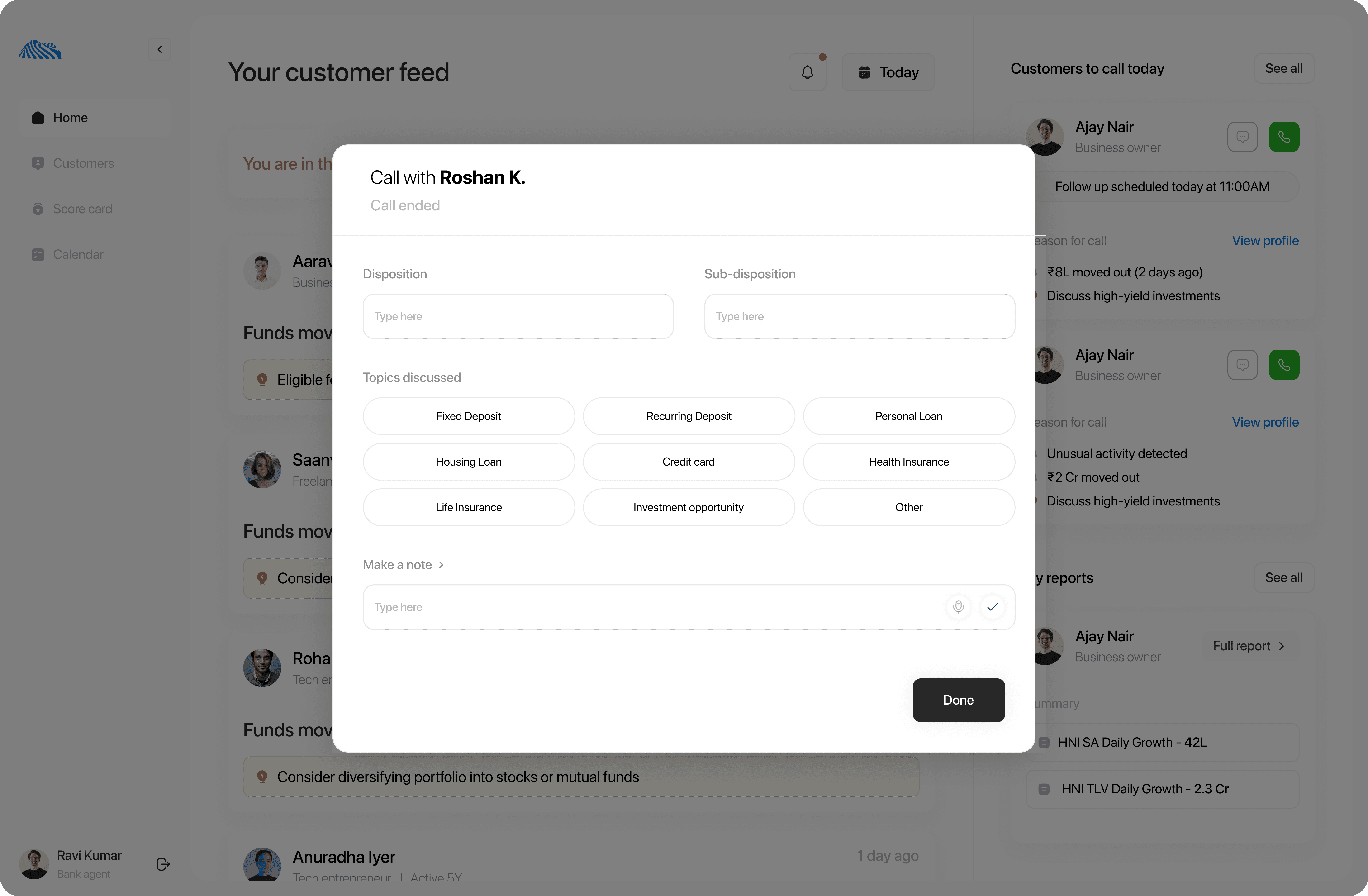

The call-end screen allows RMs to quickly log disposition, topics discussed, and notes, ensuring clean and consistent post-call documentation

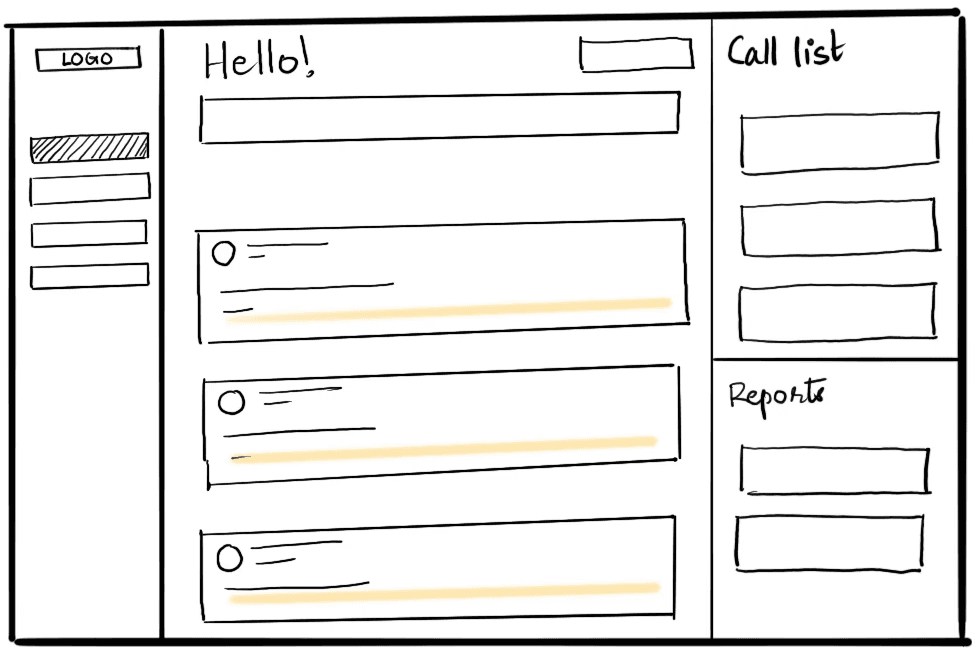

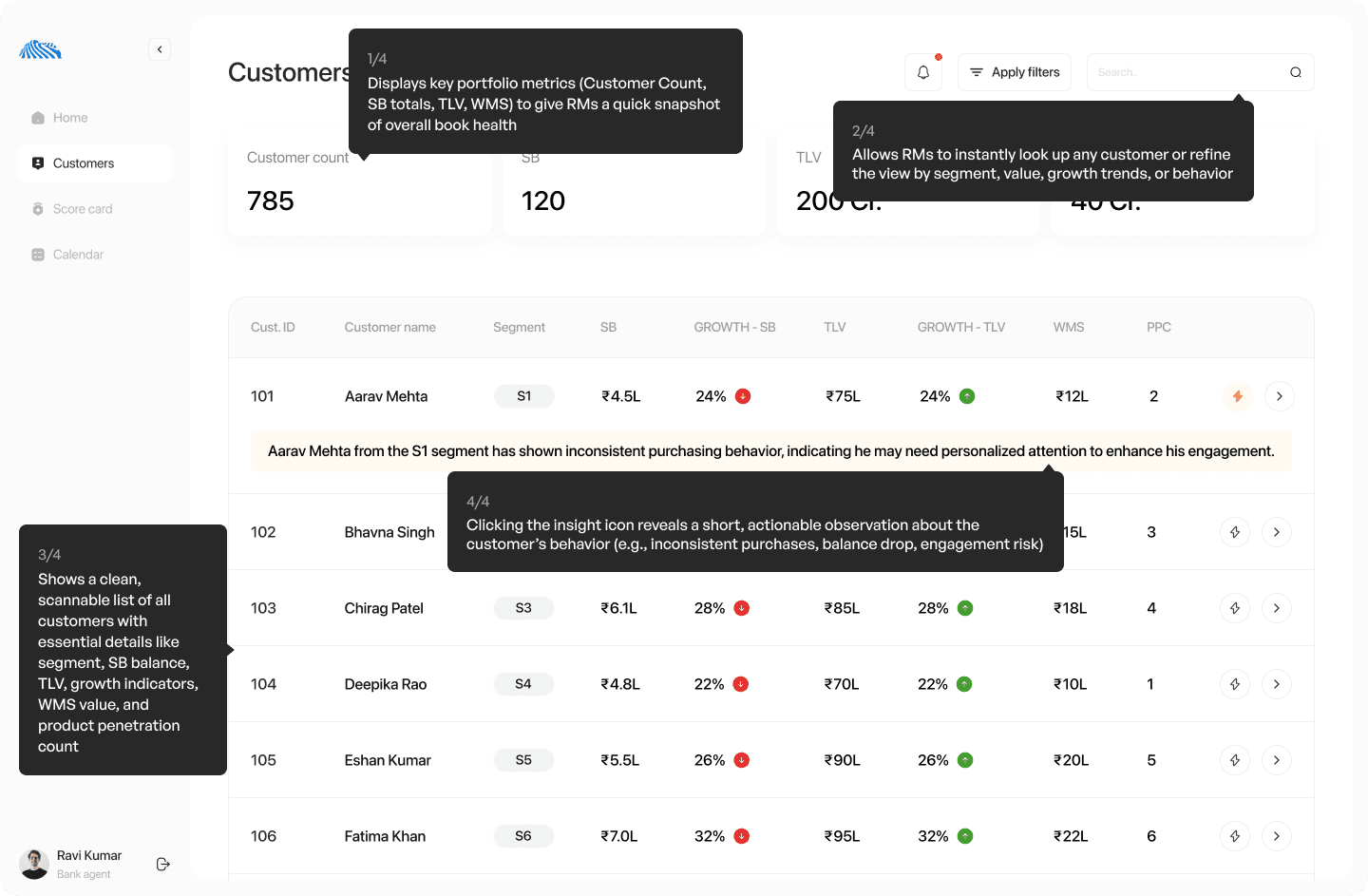

The customer list page is designed to help RMs quickly scan, compare, and prioritize customers by combining key portfolio metrics, clear growth indicators, and actionable AI insights in a clean, easily navigable table.

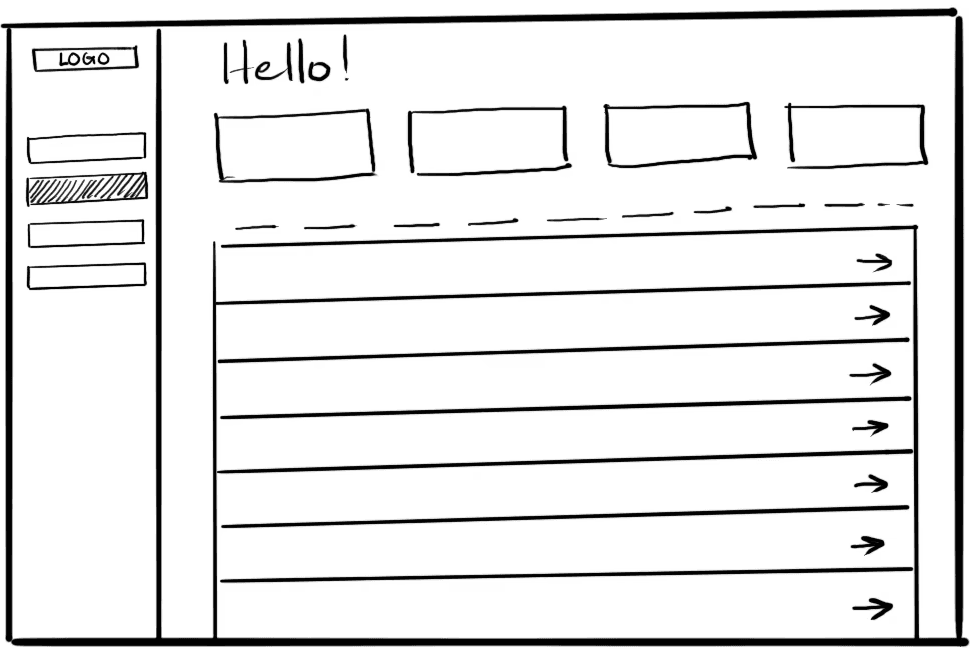

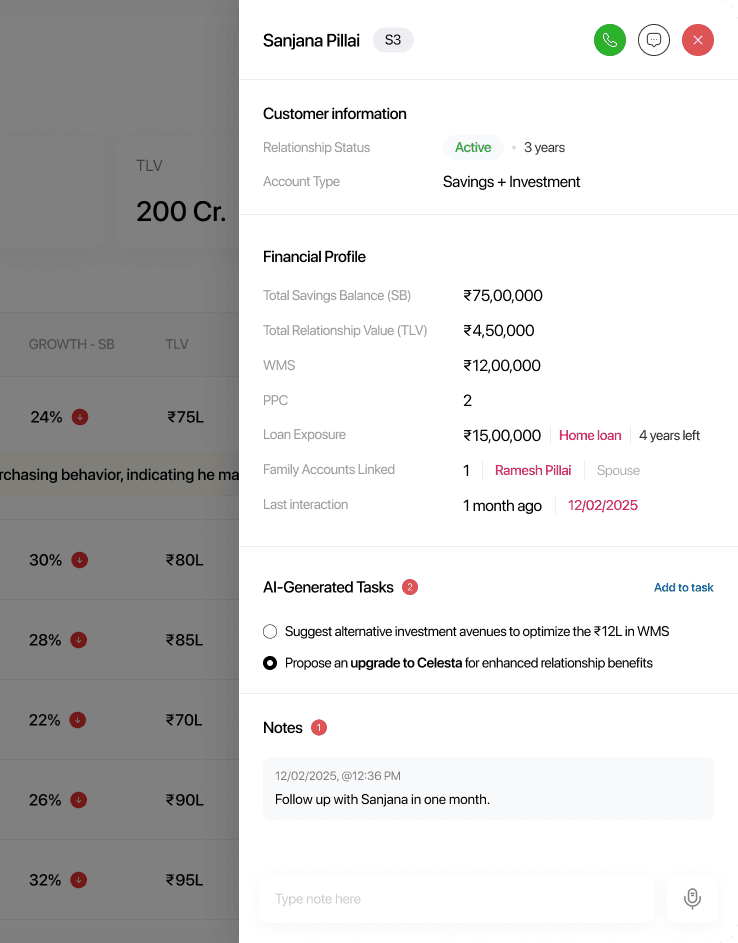

The customer profile side panel gives RMs

• A quick, consolidated view of customer details, financial metrics

• AI-generated tasks

• Recent notes to support instant decision-making without leaving the current screen

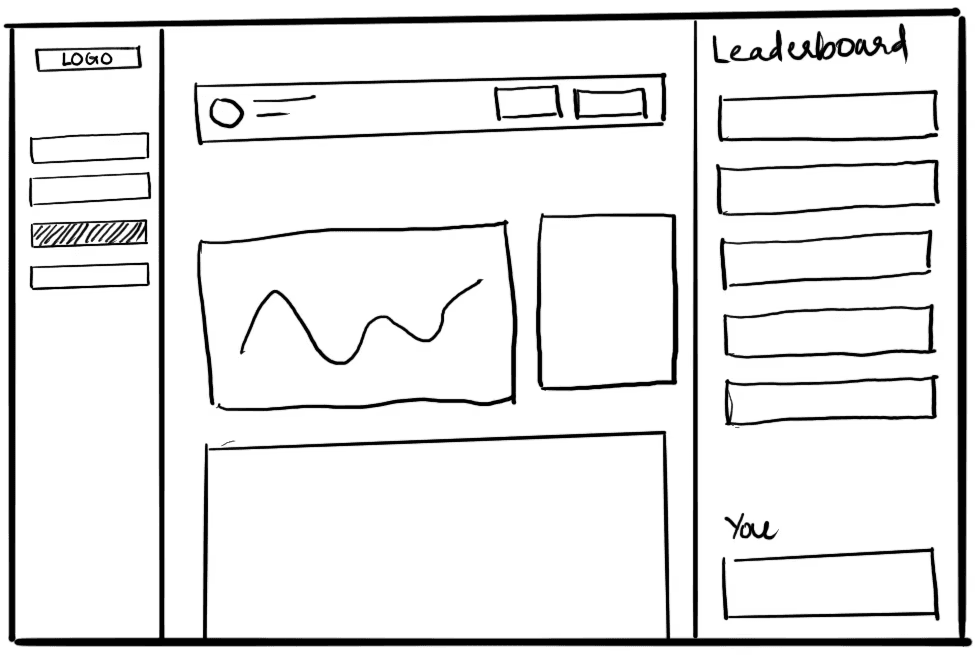

The performance page is designed to give RMs a clear, motivating view of their scores, progress trends, key business metrics, and leaderboard standing, helping them quickly understand how they’re performing and where to improve.